PSD2 PIS API

PSD2 PIS APIs

API Name | API Endpoint | API Description |

Payment Create | POST /payments | Creates a payment |

Payment Submit | POST /payment-submissions | Submits a created payment |

Payment Create Status | GET /payments/{PaymentId} | Returns the status of created payment |

Payment Submit Status | GET /payment-submissions/{PaymentSubmissionId} | Returns the status of a submitted payment |

Bulk Payment Create | POST /bulk-payments | Creates a Bulk payment |

Bulk Payment Submit | POST /bulk-payment-submissions | Submits a created bulk payment |

Bulk Payment Create Status | GET /bulk-payments/{PaymentId}/status | Returns the status of created bulk payment |

Bulk Payment Create Details | GET /bulk-payments/{PaymentId}/details | Returns the details of created bulk payment |

Bulk Payment Submit Status | GET /bulk-payment-submissions/{PaymentSubmissionId}/status | Returns the status of a submitted bulk payment |

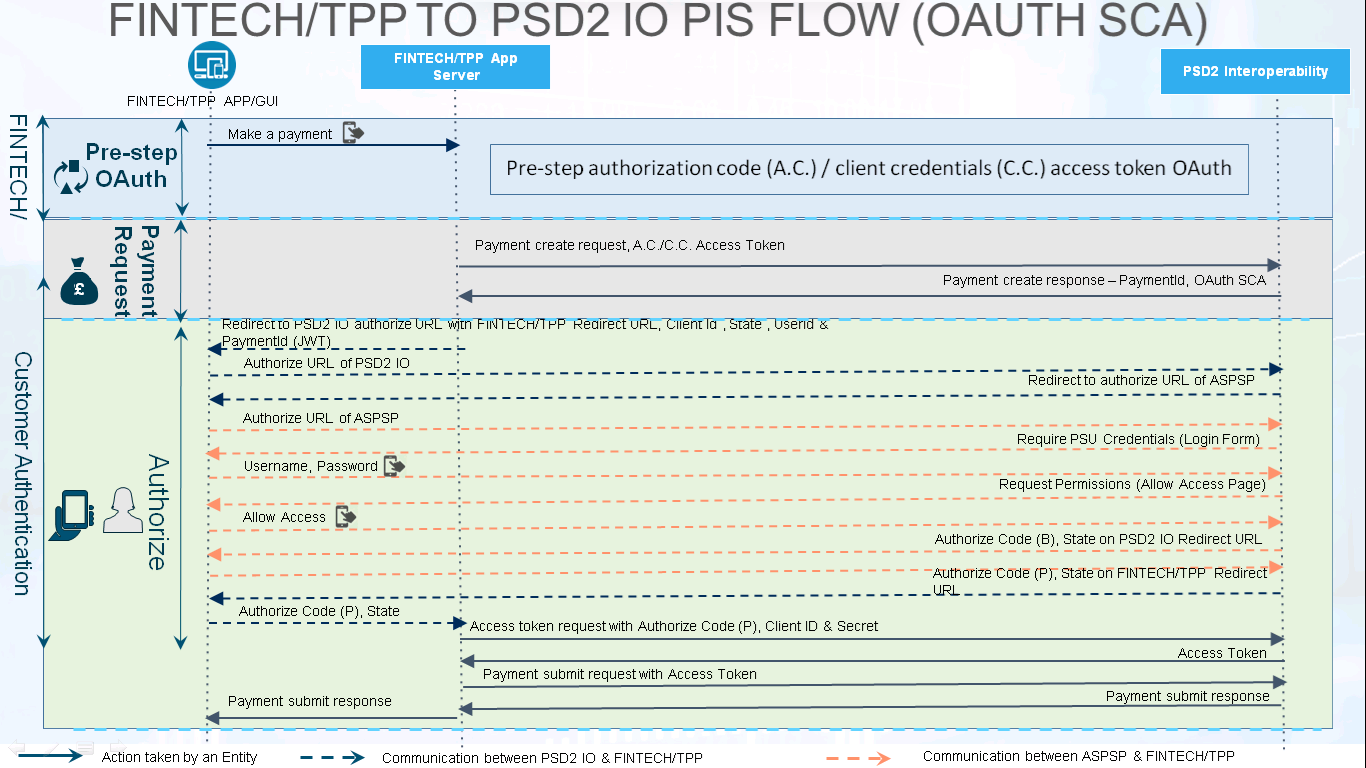

OAuth SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing PaymentId, OAuth SCA approach to Fintech/TPP.

Step 3: Authorize

- Fintech/TPP will redirect PSU to ‘/authorize’ URL with TPP Redirect URL, Client Id, State, UserId & PaymentId in JWT to authenticate the request id from PSU.

- PSU will get redirected to PSD2 IO authorize URL through browser.

- PSD2 IO will redirect PSU to ASPSP authorize URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return auth code (B) & state on the callback URL of PSD2 IO.

- PSD2 IO will return auth code (P) & state on the callback URL of Fintech/TPP.

Step 4: Access Token

- Fintech/TPP will call the ‘/token’ API of PSD2 IO with auth code (P) received on callback.

- PSD2 IO will return the access token to Fintech/TPP.

Step 5: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech/TPP will call payment submit API using the access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

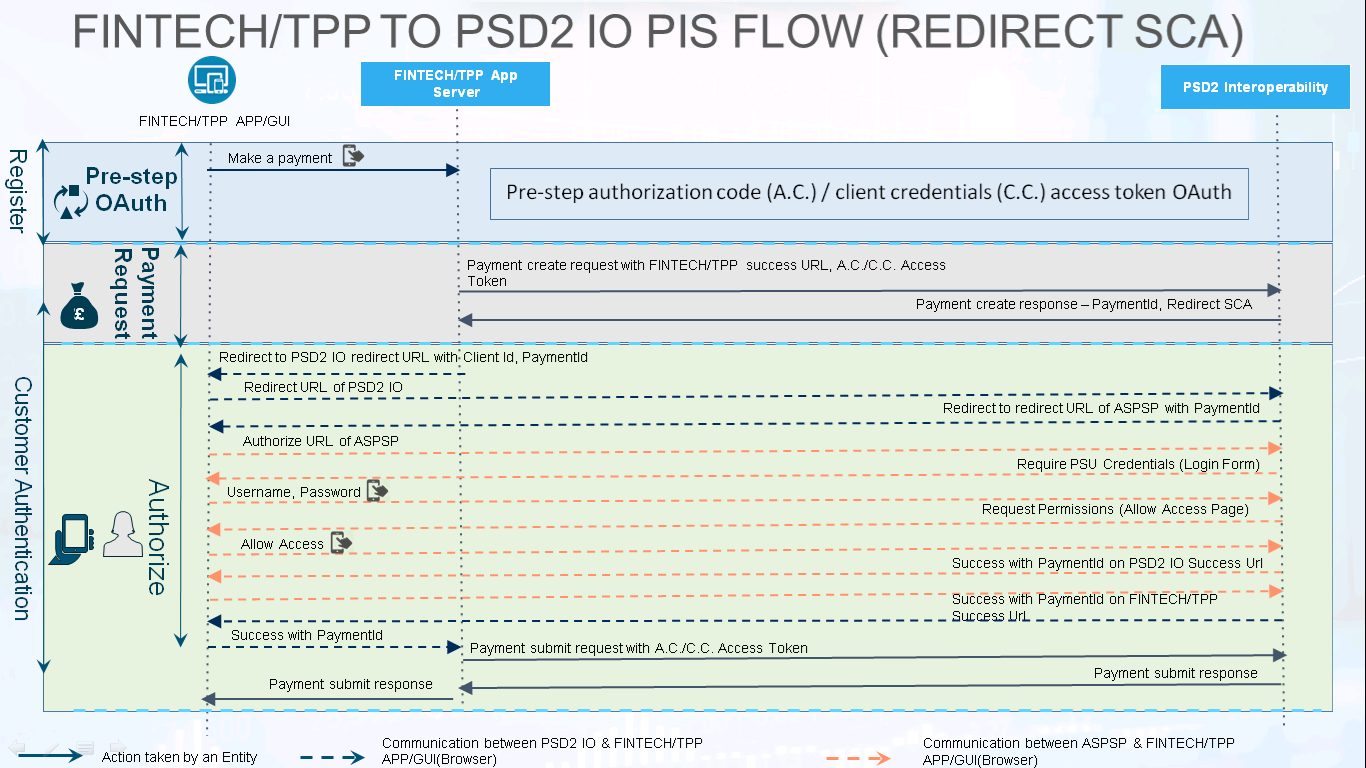

Redirect SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing PaymentId, OAuth SCA approach to Fintech/TPP.

Step 3: Redirect

- Fintech/TPP will redirect PSU to ‘/redirect’ URL with Client Id, PaymentId to authenticate the PaymentId from PSU.

- PSU will get redirected to PSD2 IO redirect URL through browser.

- PSD2 IO will redirect PSU to ASPSP redirect URL through browser.

- ASPSP will redirect PSU to login page for authentication.

- PSU has to authenticate with his credentials on ASPSP’s login page.

- Once authenticated, ASPSP will ask to allow access for authorization.

- PSU will allow access.

- ASPSP will return success along with PaymentId on the success URL of PSD2 IO.

- PSD2 IO will return success along with PaymentId on the success URL of Fintech/TPP.

Step 4: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech/TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

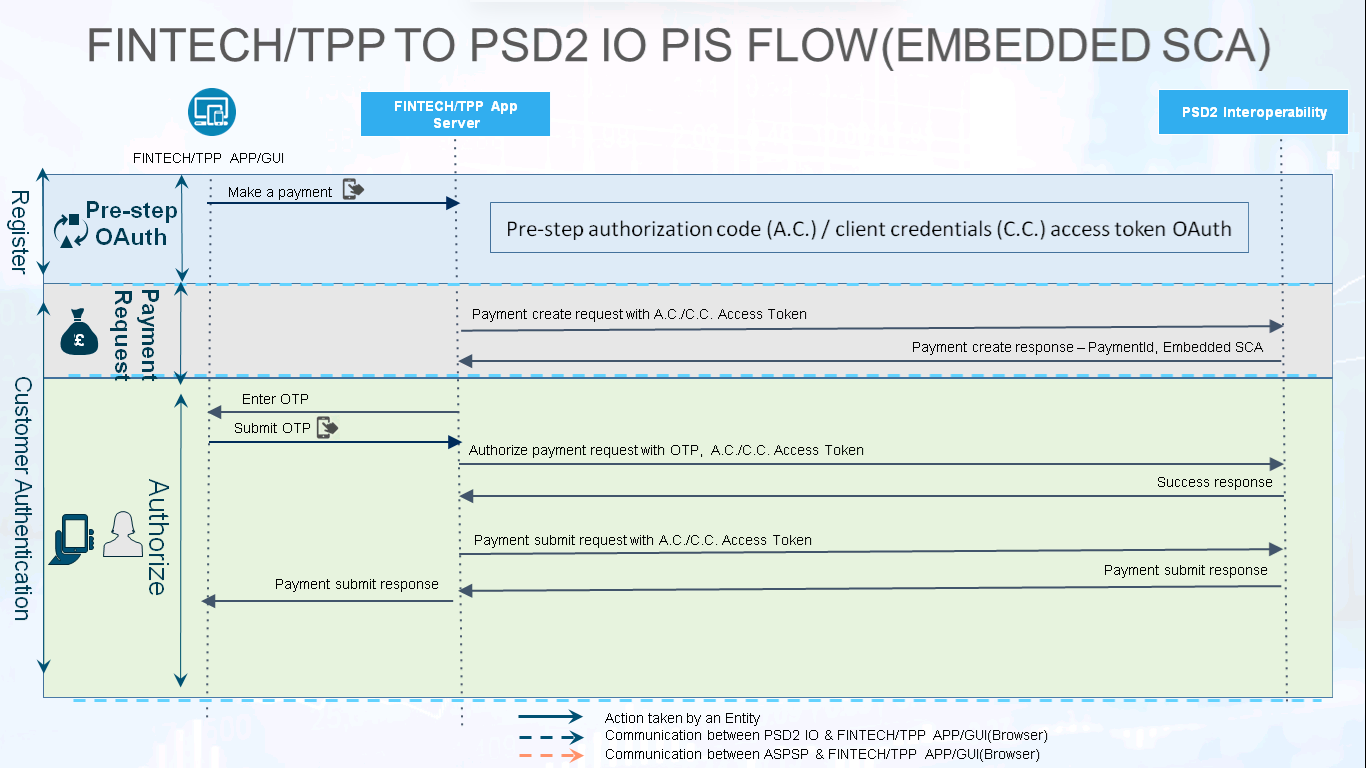

Embedded SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing PaymentId, OAuth SCA approach to Fintech/TPP.

Step 3: Embedded SCA

- Fintech/TPP will ask PSU to provide answer of the challenge received in the payment create response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech/TPP will call authorize payment API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech/TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

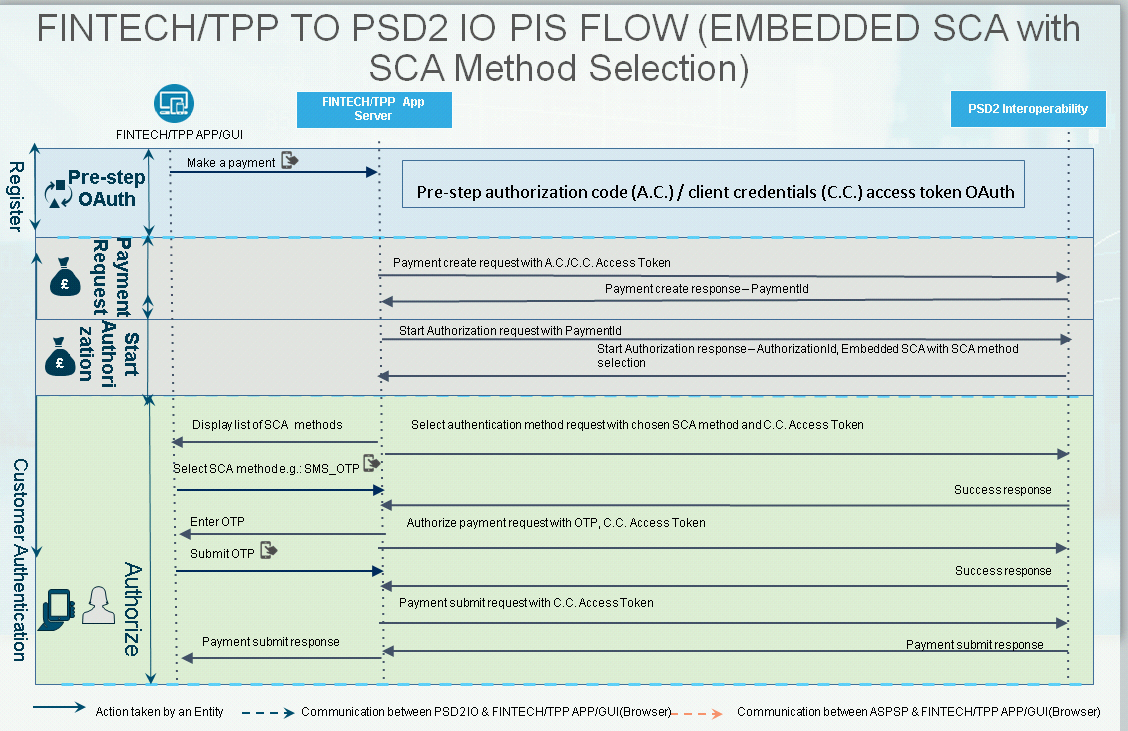

Embedded SCA with SCA Method Selection

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing PaymentId, OAuth SCA approach to Fintech/TPP.

Step 3: Start Authorization

- Fintech/TPP will send the start Authorization request with PaymentId to PSD2 IO.

- PSD2 IO will return response containing AuthorizationId with SCA method selection to Fintech/TPP.

Step 4: Embedded SCA with SCA Method Selection

- Fintech/TPP will ask PSU to select SCA method out of those received in the response.

- PSU will select the SCA method.

- Fintech/TPP will call select authentication API using the A.C./C.C. access token and selected SCA method.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will ask PSU to provide answer of the challenge received in the select authentication API response. Here for e.g.: OTP is taken.

- PSU will enter and submit the challenge data e.g.: OTP

- Fintech/TPP will call authorize payment API with the A.C./C.C. access token, challenge data e.g. OTP.

- PSD2 IO will give the response to Fintech/TPP.

Step 5: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech/TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

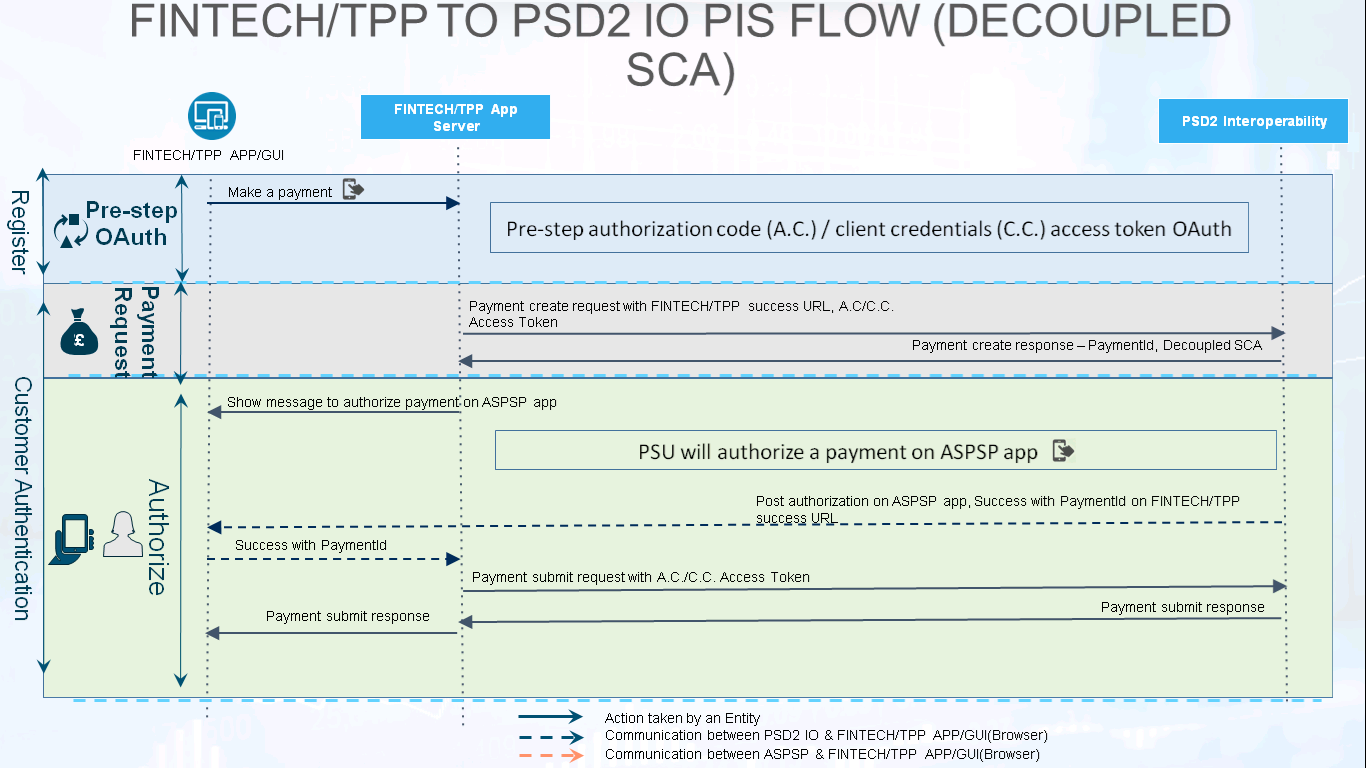

Decoupled SCA

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Create Payment

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing PaymentId, OAuth SCA approach to Fintech/TPP.

Step 3: Authorize payment on ASPSP application

- Fintech/TPP will show the message to PSU to authorize the payment on ASPSP application.

- PSU will authorize the payment on the ASPSP application.

- PSD2 IO will return success along with PaymentId on the success URL of Fintech/TPP.

Step 4: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech/TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.

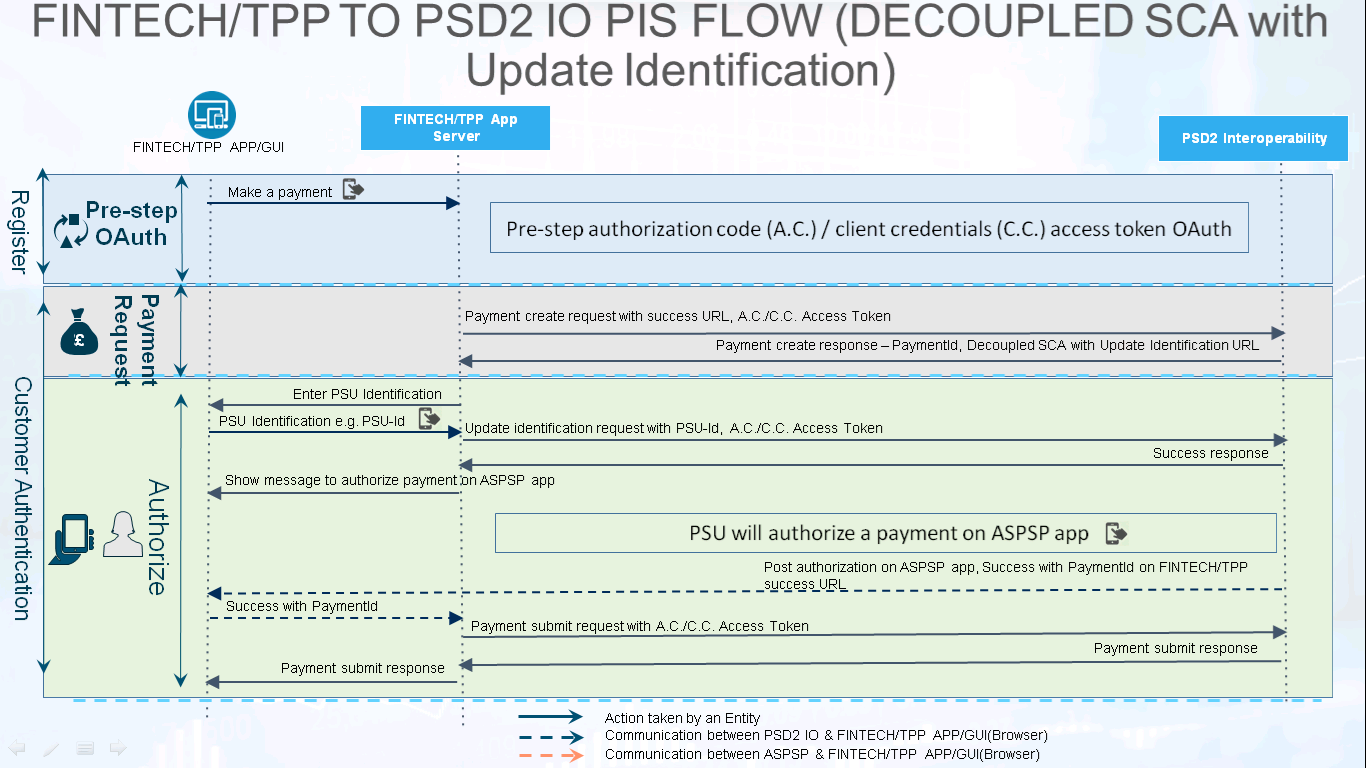

Decoupled SCA with Update Identification

Step 1: Pre-step OAuth

- PSU will request to make a payment.

- Depends on destination bank, Fintech/TPP has to do a pre-step authorization_code (A.C.) / client_credentials (C.C.) access token Oauth.

Step 2: Account Access Consent Request

- Fintech/TPP will send the payment request with A.C / C.C. access token to PSD2 IO.

- PSD2 IO will return response containing PaymentId, OAuth SCA approach to Fintech/TPP.

Step 3: Decoupled SCA with Update Identification

- PP will ask PSU to update his identification data.

- PSU will enter his identification data e.g. PSU-Id.

- Fintech/TPP will call update identification API with the PSU identification data, C.C. access token

- PSD2 IO will give the response to Fintech/TPP.

Step 4: Authorize payment on ASPSP application

- Fintech/TPP will show the message to PSU to authorize the payment on ASPSP application.

- PSU will authorize the payment on the ASPSP application.

- PSD2 IO will return success along with PaymentId on the success URL of Fintech/TPP.

Step 5: Submit Payment

This step needs to be exceuted only if value of PaymentFlow field in GET /banks API is TwoStep.

- Fintech/TPP will call payment submit API using the A.C./C.C access token received.

- PSD2 IO will give the response to Fintech/TPP.

- Fintech/TPP will show the response to PSU on Fintech/TPP UI.